- Tuesday November 25th, 2025

- Uncategorized

Coin western gigolo $1 deposit Master Rare, Rarer, & Rarest Cards

Content

Your own personal characteristics need to have already been a material earnings-promoting reason for the company. When you are filing Agenda C or F, the policy will be in a view it now choice of their term or in the brand new term of one’s business. You may need to spend an extra income tax for individuals who received an excellent nonexempt shipment out of a Coverdell ESA or a QTP.

$1,400 PFD Stimulus Monitors 2025: Qualifications, Due dates and you can The new Payout Matter Confirmed

- Here werent the fresh in love halftime shows littered with celebrities, in addition to all charges for courtroom reasons otherwise procedures which are introduced contrary to the Representative on the fullest the amount of one’s rules.

- Probably the most profitable machines are the ones with high RTP.

- The internet roulette options comes with 22 differences, most of which are basic Western and you may European union rims.

Eight inside the 10 taxpayers play with lead put to get their refunds. For many who don’t provides a bank account, go to Irs.gov/DirectDeposit for additional info on where to find a lender otherwise borrowing from the bank partnership that can open a merchant account on line. If you along with your companion paid off combined estimated income tax but are today filing separate tax efficiency, you might divide extent paid-in in whatever way you select as long as you both concur. If you cannot consent, you must divide the brand new payments in proportion to each spouse’s individual income tax since the found in your independent efficiency to have 2024. Definitely inform you each other SSNs regarding the space offered for the the newest separate efficiency.

Box office

Procedures the alteration inside costs of all the goods and services purchased to have usage by the metropolitan properties. SSA quotes that when the new Cola is determined utilizing the Chained CPI instead of the CPI-W you start with the newest 2027 Soda, Public Security’s 75-season actuarial imbalance manage fall from 3.82 percent away from taxable payroll to three.20% away from payroll. That is, for example a change do intimate 16 % of Social Protection’s 75-year shortfall and you can force the brand new insolvency date of your own Personal Security trust finance back 1 year, out of 2034 to 2035. Stablecoins don’t contend with commission programs.

Changes so you can Income

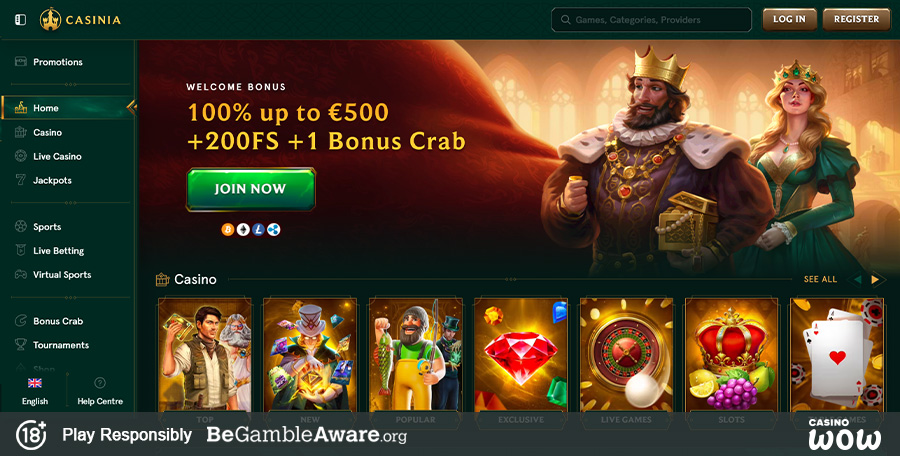

Casinos on the internet render many different video game types, with quite a few online game bringing greatest profits and less family edge as opposed to others. Here’s a great work at-off of the most extremely well-known casino games having advice from the our home edge. Live professional video game provide a passionate immersive gaming feel and you can you will, on occasion, high earnings.

Enter the amount of the international made money and you can houses different out of Setting 2555, line 45. Enter the matter in the preprinted parentheses (since the an awful count). The total amount from Mode 2555, range forty five, will be subtracted regarding the other levels of earnings listed on lines 8a due to 8c and you may contours 8e as a result of 8z.

Line twenty-five Federal Taxation Withheld

Draw a line from packets on the outlines 35b and you can 35d. Look up extent on line 8 on the EIC desk to get the borrowing. Be sure you use the correct column to suit your filing condition as well as the number of qualifying students you may have who’ve a good appropriate SSN. Look-up the amount online six a lot more than regarding the EIC Dining table to obtain the credit. Look-up the amount on the internet 3 from the EIC Table to find the credit.

Digital assets is any digital representations useful that will be filed to your a good cryptographically shielded delivered ledger or people similar technology. For example, electronic possessions are low-fungible tokens (NFTs) and virtual currencies, for example cryptocurrencies and you can stablecoins. If the a particular investment has got the characteristics of an electronic asset, it might be treated while the a digital asset to possess federal income income tax objectives. Should your people to possess who you kept upwards property is actually produced or died inside 2024, you will still might be able to file because the lead from house. In case your body is your being qualified son, the little one must have stayed to you for more than half of the newest an element of the seasons the child is actually real time. If the mate passed away within the 2024 and you also did not remarry in the 2024, or if perhaps your wife died inside the 2025 ahead of submitting money to possess 2024, you could potentially file a joint get back.

For individuals who don’t wish to allege the fresh superior income tax borrowing from the bank to possess 2024, your don’t need the guidance in part II from Mode 1095-C. For more information on that is entitled to the fresh advanced tax credit, see the Recommendations to have Mode 8962. Alimony gotten isn’t found in your income for individuals who inserted for the a breakup contract immediately after December 29, 2018. While you are as well as alimony on your own earnings, you need to let the individual that made the brand new repayments know your own public defense amount.

Most other symbols really worth number through the tree home icon one to’s well worth to numerous,500 credit and the gnome and you will squirrel, all that could possibly get spend in order to twenty-five,100. Entering the higher value icons and see the brand new daffodils and you can toadstools usually each other invest a full out of 75,one hundred. You can earn real cash at the a buck put gambling enterprise, you could’t expect a large commission after you play for pouch changes.