- Tuesday October 14th, 2025

- Uncategorized

The five Greatest $step one Put Casinos inside 2025 Get up So you can 80 Totally Your Domain Name free Spins

There’s shelter on top of the blockchain technical, that’s a little safe. As among the greatest internet sites to have online web based poker gambling experience, Currency Web based poker provides an excellent following one of the Bitcoin casinos. The benefit of and this Bitcoin betting site is the punctual distributions along with direction to own types of money. The player isn’t simply for playing with FIAT otherwise cryptos, as this is one of the websites you to accept Bitcoin. Okay, so that you got some cash and wish to get it from a casino poker or even to experience site. Monitors are supplied, yet not, who’s back to one cuatro date recovery on which you’ll come to be an adverse take a look at.

An excellent half dozen-profile paycheck is actually one income you to definitely’s more $99,999 much less than $step one,100,100000. Someone talking about how much is actually 6 rates within the cash is constantly these are people’s earnings a-year prior to income tax and any other write-offs. It might otherwise may well not range from the property value most other pros it found. Currency business profile (MMAs) is a type of savings deposit account provided by borrowing from the bank unions and you will financial institutions. This type of profile often provide high interest levels than simply standard discounts membership, nevertheless they might need increased lowest put as well as might need you to definitely keep a much bigger equilibrium on the membership. Sure, some gambling enterprises render legit $a hundred no deposit bonuses, but quicker also offers are generally easier to cash out and much more well-known within the legitimate casinos one keep a professional license.

Within the a defined Your Domain Name benefit plan, the level of advantages to be provided to every participant are spelled call at the master plan. The plan manager numbers the quantity needed to provide the individuals advantages, and people amounts try resulted in the master plan. Outlined benefit preparations are retirement arrangements and annuity plans. To own purposes of the fresh IRA deduction, federal judges is actually covered by an employer senior years bundle. If you were divorced otherwise legally broke up (and you can did not remarry) until the stop of the year, you simply can’t subtract any benefits on the spouse’s IRA.

To quit later-commission penalties and you can focus, spend your taxes in full by the April 15, 2025 (for many people). See how to Spend, afterwards, to own information about how to spend the quantity you borrowed from. You can have a reimbursement take a look at shipped for your requirements, or you can get refund transferred straight to their checking otherwise savings account or split up certainly two or three accounts. Which have age-file, your reimburse was given shorter than simply for many who filed to your report. The newest Self-Find PIN approach makes you create your own PIN.

In may, the fresh employer delivered Ari in order to Hillcrest to have cuatro days and paid off the hotel in person to your resorts statement. Because their $700 away from expenditures are more than just the $618 improve, it range from the an excessive amount of expenses after they itemize their deductions. It complete Mode 2106 (showing almost all their expenses and you may reimbursements). They have to as well as spend some their reimbursement anywhere between their dishes or other expenses while the talked about later lower than Finishing Mode 2106. An excess reimbursement or allotment try one count you are paid which is more the organization-associated costs which you sufficiently accounted for to the employer.

You’ll also receive increased fundamental deduction than simply for individuals who document because the single otherwise hitched submitting on their own.. For many who positively participated in an inactive rental a property interest you to definitely brought a loss, you could potentially basically deduct losing from your nonpassive income, around $twenty five,100. However, hitched individuals submitting independent production just who stayed with her any moment inside year is’t allege that it unique allocation.

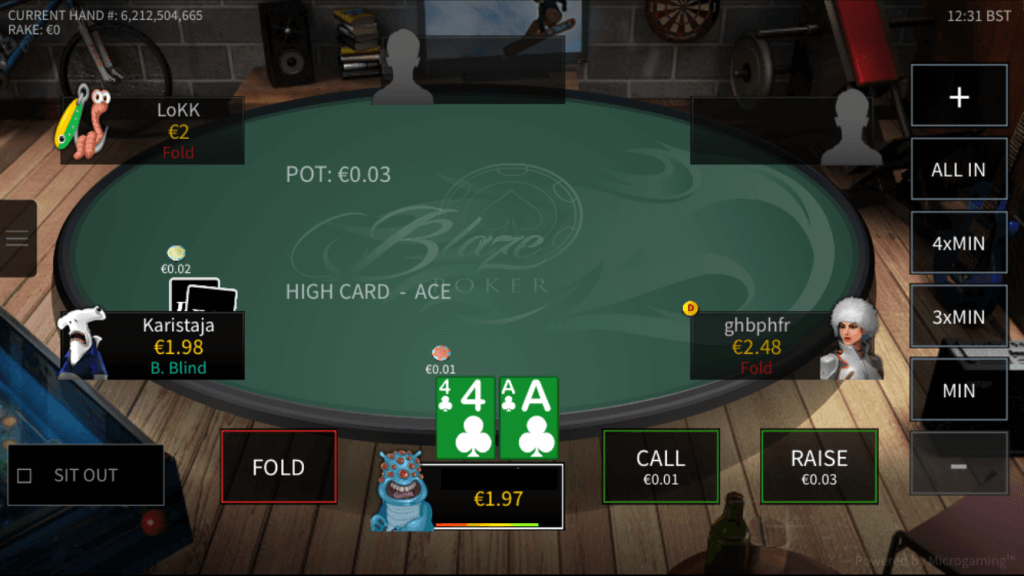

Just what are Minimal Deposit Casinos? | Your Domain Name

With any luck, he’ll discover the minimal deposit casino that meets him finest instead of ever being required to reload. No less than, this will help your determine whether and then make a much bigger put. A deposit match bonus offers totally free bucks to experience which have on top of your own deposit, to a certain amount otherwise percentage.

What’s the new 9 data definition?

Of this number, $3,700 are on their own mentioned since the low-entertainment-related meals and you will $1,100000 are individually mentioned as the entertainment. Given that you’re notice-operating, your aren’t refunded for the of the take a trip expenditures. Your contour your allowable travelling costs the following.

For individuals who found real private assets (aside from cash, a gift certification, otherwise a similar goods) as the a honor for duration of provider otherwise protection conclusion, you could essentially exclude their well worth from the earnings. Extent you could prohibit is restricted to your employer’s prices and will’t be much more than $step one,600 for accredited bundle prizes or $400 to own nonqualified package awards for everybody for example prizes you can get inside the year. Your employer will highlight in case your honor is a qualified plan honor.

Psychological worry includes actual symptoms you to originate from mental worry, such concerns, insomnia, and you can belly issues. Don’t use in your revenue compensatory damages for personal real burns off otherwise physical illness (if or not gotten within the a lump sum payment otherwise payments). To choose in the event the settlement amounts you get from the sacrifice or view need to be utilized in your earnings, you need to consider the goods the payment changes. The smoothness of the income since the normal money otherwise financing acquire utilizes the nature of your root claim. For those who obtained an installment out of Alaska’s nutrient income financing (Alaska Permanent Financing bonus), declaration it as earnings for the Agenda 1 (Setting 1040), line 8g. The state of Alaska directs for every recipient a document that shows the amount of the brand new commission on the take a look at.

We will always be up to date with typically the most popular harbors in america. You can test aside any slot machine game to your the website to own totally free within the demonstration setting. We as well as ability the game alongside a connected casino for the comfort. Gambling establishment Brango also provides 2 hundred Totally free Spins to your Spicy Reels Fiesta.

You should file a last come back to possess a good decedent (somebody who died) in the event the both of listed here are real. For many who owe more taxation, you happen to be capable spend on the internet or because of the mobile phone. Brief graphic icons, or symbols, are used to draw your awareness of special guidance. Come across Desk 1 to own a description of each and every icon found in so it book.

Your own mother acquired $2,eight hundred in the personal security professionals and you will $three hundred inside focus, paid off $dos,100 to own rooms and you can $400 to have athletics, and set $three hundred inside the a family savings. Your contour whether or not you have provided more than half away from a person’s overall assistance because of the contrasting the amount your triggered you to definitely person’s help on the entire number of help that individual gotten from the offer. This includes support the person provided on the individual’s own money.

For information regarding figuring the get and reporting they inside the earnings, find Is Withdrawals Taxable, before. The fresh shipment is generally subject to extra fees or punishment. You could make these types of installment benefits even when they’d lead to your overall efforts on the IRA to be more the new standard limitation on the benefits. As eligible to build these cost benefits, you really must have gotten a qualified reservist shipping out of a keen IRA or from a paragraph 401(k) otherwise 403(b) package otherwise similar arrangement. For individuals who aren’t a worker and also the costs to suit your functions from a great unmarried payer during the brand new payer’s trade otherwise business total $600 or even more on the 12 months, the new payer will be send you a form 1099-NEC. You may have to report their fees as the mind-a job money.